On February 5th 2019 the Mexican Council of Foreign Relations (COMEXI) hosted in collaboration with EDC Mexico (Export Development Canada) and the Embassy of Canada in Mexico the "Economic Forecast 2020. This conference featured Peter Hall (EDC Mexico's Chief Economist), Mario Correa (Scotiabank Mexico's Chief Economist). The discussion was moderated by Luis De La Calle (founding associate at De La Calle, Madrazo, Mancera and COMEXI associate).

The conference was inaugurated by Verónica Ortiz, Executive Director of COMEXI. She was glad to say that it is the second year in a row that COMEXI co-hosts the event with the support of Export Development Canada (EDC) and the Canadian Embassy in order to strengthen the Mexico-Canada relationship.

She asserted that today’s presentation is relevant for the global context, where Peter Hall, Vice-President and Chief Economist of Export Development Canada (EDC), shares his 2020 Global Forecast and Mario Correa, chief-economist at Scotiabank gives his insight about the mexican economy. The discussion is moderated by Luis De La Calle, a COMEXI member and founding partner at De la Calle, Madrazo, Mancera.

Jorge Rave, Chief Representative of EDC for Mexico welcomed everyone and thanked the support of the Canadian presence in Mexico. He stated that 2020 is a very important year for EDC, considering that last year Mexico and Canada celebrated 75 years of diplomatic relations and EDC also celebrated 75 years of operations. This year is the 20th anniversary of EDC in Mexico, where it had its very first representation in the world. To commemorate this important milestone, there were a series of events in Mexico and Canada to highlight the work that has been done for Canadian investors and exporters.

Mr. Rave expressed that Mexico is one of the most important markets for EDC, as there is a lot of opportunities for Canadian investors. Important trade relationships have been developed over time and he hoped that those relationships will only be reinforced in the years to come. Over the past 20 years, EDC has been working closely with its partners towards this goal, which includes the Canadian Trade Commissioner Service and the Canadian provinces in Mexico: Quebec, Ontario and Alberta. He claimed that EDC is in a unique position to open markets through particular strategies that lend support to Canadian investors and exporters.

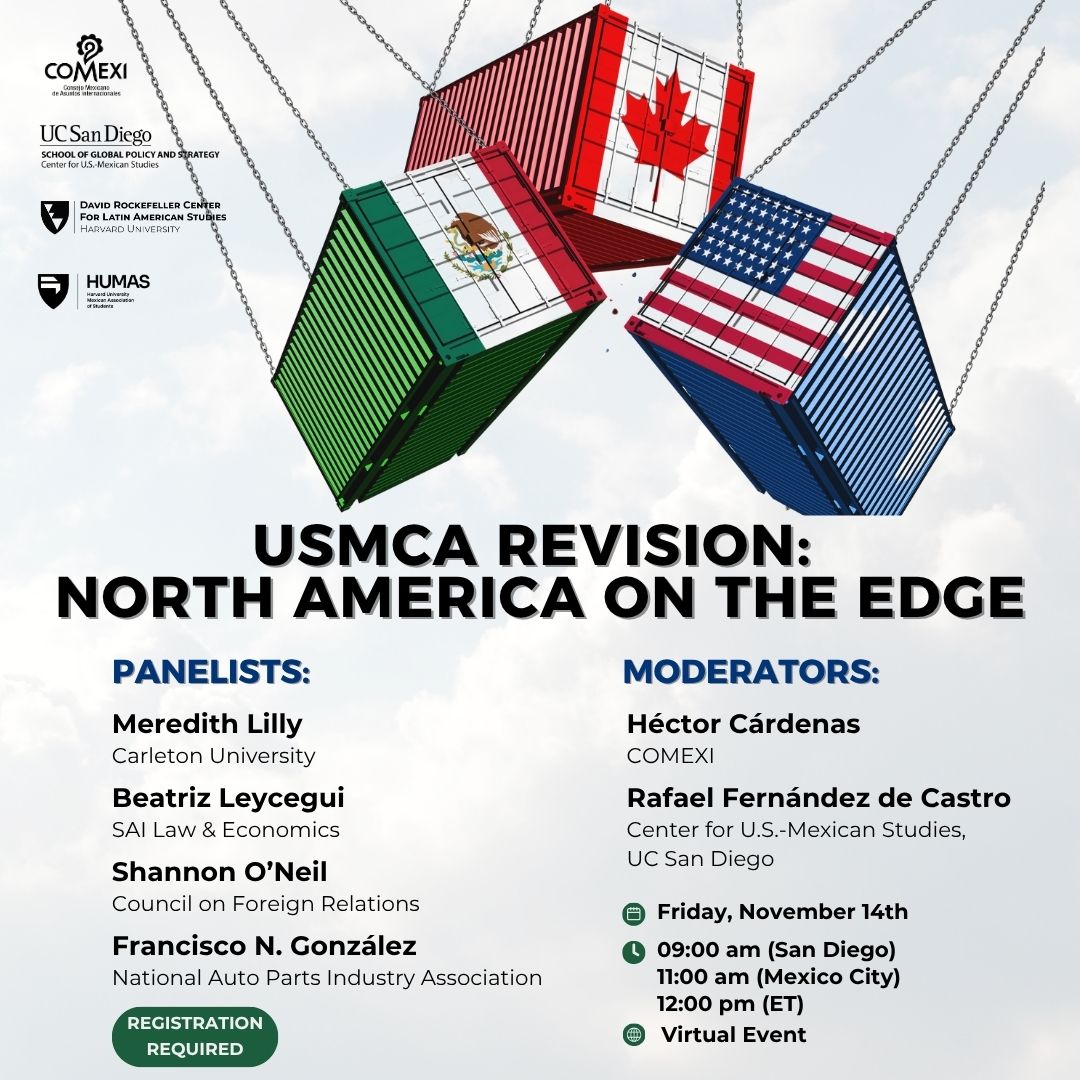

The panel started with the moderator’s presentation on the current world situation and he pointed out that it is at a difficult stage and North America has an opportunity to innovate and take advantage of the USMCA working together through the unique per-resolution system. He claimed that the success of tomorrow will depend on the investments done today.

Peter Hall started his presentation stating that even though there is a structured deal in place, such as the new United States-Mexico-Canada Agreement (USMCA), there is not much good in having that deal if there is no growth in the world economy to take advantage of, and if there are no political structures that are sympathetic with the aims of the deal.

Regarding world economic development, Mr. Hall claimed that growth is necessary as an engine of investment and that the greatest risk nowadays is business investment. He noted that the presentation’s title, “Investment in a hesitant world”, reflects the truth about the state of the economy, which may be good, neutral or bad. He explained that, though purchasing managers around the world are claiming that trends in the US are good, trends in the rest of the world are looking gloomy. He said we can trust in the purchasing managers’ forecast because they don’t have the luxury of being wrong. There’s a Darwinian element to being a purchasing manager: they have to be right. He admitted that when he looks at the state of the economy in their forecast, there are many reasons to be pessimistic.

Mr. Hall asserted that industrial production and trade flows among countries show some degree of recession. As elected leaders were questioning the system, both in the United Kingdom (UK) with “Brexit” and in the US with the election of Donald Trump, the world economy by itself was getting back on its feet again, and after many years of stagnation, it reflected a slowdown. He questioned that maybe we are due for a global economic slowdown right now due to the fact that it has being eleven years since the last one. But time doesn’t stamp the need for a recession, Mr. Hall said. One of the fundamentals for economic slumps are housing bubbles; housing is one the most dependable indicators of economic activity. Mr. Hall remembered 2008, when there were massive bubbles in the US and in Western Europe and it was absolute carnage.

Afterwards, he claimed there has to be some kind of bubble after all that time following the last recession, and that surely, irrational exuberance has taken over the housing market. But the exact opposite is true, he said. The US housing market has a deficit and it is as great as the bubble back in 2008; which indicates the US economy can still grow, but many are forecasting the other way around. He said that the exact same phenomenon is happening in the European market, and that the region also has big possibilities of growth.

Mr. Hall established that the way in which fiscal and monetary policy was managed in the world economy during the post-recession period, has distorted some of the financial market leading indicators. These indicators are not working now because of the ups and downs of the economy, but if they are finally recovering, this late stage upgrade is a leading indicator of economic activity and it suggests that our underlying growth is much stronger.

In order to reconcile how growth is changing, Mr. Hall conducted an analysis of various individual countries’ investments and trade performances and concluded that those sectors are underperforming, which is leading to a global slowdown. However, consumer spending, which is a big percentage of most economies, is flourishing in spite of all the turmoil happening in the world; the bulk of the economy is still growing.

He pointed out that the economy is behaving opposite to how it normally does. A recession usually happens inside the housing market and for most of the people, a house is their greatest investment. When prices plunge, a sequence ensues as the economy slows down: the consumer slows down, business have a hard time catching up, inventories rise, industrial production pulls back and so does international trade. He declared that it is only years later that investment drops; there is a lag in investment because projects take time and can’t be shut down immediately. It’s only in a time of crisis when investment can respond quickly, which is what Mr. Hall affirmed is happening now.

He claimed that what the world is seeing now in the economy is a false drop; this is led by something other than fundamental economic activity. Mr. Hall called attention to the global uncertainty that is permeating the economy nowadays; an exponential increase in uncertainty will have repercussions in investment and trade. China is one of the big drivers of this uncertainty and even with its spectacular growth, now with the imposition of policy, there is no other place in the planet more uncertain and fearful, he said.

Mr. Hall suggested that the rise of uncertainty and populism can be reflected inside the marketplace. It doesn’t matter if it’s right-wing or left-wing populism, the uncertainty factor cuts right across the political spectrum. Years ago, a strange phenomenon started to occur: as unemployment rates went down, more people left the labor force, which resulted in a lack of economic growth and it sparked protests around the world. Populism then gave rise to politicians that put policies into place that haven’t worked, which is our context currently. He concluded that the reason investment is holding back has to do with populists because they don’t believe in the political system anymore and they are certainly not friends of globalization.

Subsequently, Mr. Hall contended that there is a method behind the madness of policy-making, especially in the trade front. The logic that drives this kind of thinking is economic, and it applies for Brexit, the US-China trade war, as well as for the current trade deal; it is much better than having no deal at all, he said. From a global outlook, there is enough evidence that shows that those in power want to put things back together again and are challenging existing norms; he insisted that the outcome will not be a blow up for globalization but a strengthening of globalization.

Mr. Hall concluded his exposition with three pieces of advice:

1. Go for the gap: while businesses are running away from a complicated situation, there is an opportunity to create relationships and do business because the world is fundamentally strong

2. Surf the surge: if there is a great investment holdback and there is no good reason for it, it will be like stopping a fast flowing river. When people realize that globalization is being strengthened, investment will flow back into the world economy and we should prepare ourselves for it

3. Dare to diversify: this is where all growth will go forward.

Following Mr. Hall’s presentation, Luis De la Calle thanked him for his participation and gave Mario Correa the floor for a prospective on Mexico’s economy. Mr. Correa expressed his pleasure for being able to share his thoughts about what is happening with the Mexican economy and started his presentation quoting Mark Twain: “You cannot depend on your eyes when your imagination is out of focus”, which he related with the current context.

He gave a brief outline of Mexico’s economy where there is supposedly optimism in financial markets, which can be reflected on a global level. He posited that the feeling of uncertainty, which is having a toll on the financial markets, comes from fears of a possible confrontation between the US and China in the commercial arena, Brexit, and the agreement of the new trade deal.

Mr. Correa maintained that Mexico has experienced a severe contraction of investment in the last decade. Then, he presented various percentages and numbers about the Mexican economy and what it needs to do so it starts growing again: more than 80% of total investment is realized by the private sector, while the public sector produces about 10% of them. That means that if the country wants to increase in this area, the private sector needs to solve its issues and start investing again. He explained that even though the largest firms in Mexico are not doing that, they don’t even reach 3% of total investment. So, it is not a matter of the largest firms in Mexico to start investing again; most of the employment opportunities and investment in our country are produced by small to medium sized companies and those are the ones that need to start spending and investing again. He highlighted that most of them are concentrated on retail trade, services, restaurants and hotels.

Next, Mr. Correa talked about public policy and how its disruptions have had an important effect on the global economy. As an example, he mentioned the “Cobra Effect”, which took place in India during the British occupation. The government became aware that many people were dying because of snake bites, so they rewarded for every dead cobra; however, they realized that this strategy was not the best solution as people kept dying while they wasted money. Later on, they realized that people were breeding cobras in order to cash money from the government, because it was cheaper to breed cobras than hunting them. This a good example of what happens in an economy when there are poor policy decisions, he said.

In his analysis, he specified that Mexico’s GDP is at the weakest level in many years without a crisis, as is private consumption. He predicted that the exchange rate and finances will react to conditions in the global environment. In terms of the public finances and the federal government, fiscal revenues are not growing at the necessary rate. He stated that investment is discouraged because of the perceived insecurity in the country: robberies to business have been growing and businessmen are worried about crime related activities. The energy sector could have an impact and there is a lot of potential to boost investment, but it doesn’t seem to be the priority. Fortunately, he said, inflation is not a problem now and will probably rise slightly within the range set by Mexico’s Central Bank. Overall, he was of the opinion that it is not a catastrophic scenario but it is a weak growth scenario.

Mr. Correa agreed with Mr. De la Calle that there is great potential in Mexico and huge opportunities for the North American region to be more integrated and competitive with the rest of the world. He claimed that Mexico has the needed inputs for a long term growth: natural resources, young labor population, capital infrastructure, etc. To have a successful result, he insisted on the importance of having macroeconomic stability, a strong rule of law and institutions, as well as productive investments. There is a need for new long term investments and infrastructure projects that require a strong rule of law in the future. Mr. Correa also underscored the need for effective markets, for instance labor markets, that are able adapt to the changing circumstances.

The last few minutes of the conference were dedicated to a brief Q&A, where Luis de la Calle first asked Peter Hall about Mexico’s situation from the perspective of Canada and the future of the USMCA. Mr. Hall explained that domestic investors in the energy sector specifically are feeling more pessimistic about investing in their own country than non-energy foreign investors. Mr. Correa chimed in the discussion and said that “real” investors are concerned about possible changes in public policy and are taking a more conscious view. He said that we have now a strong fiscal stance but wonders if it’s going to last through the current administration.

Mr. De La Calle later engaged both in a discussion about liquidity in the markets and if we should expect either future investment or excess liquidity that might destroy markets. Mr. Correa stated that North America has huge potential but he warns against using monetary policy to address every ache in the economy. Mr. Hall was of the opinion that the issue of absorption of excess liquidity is going to be one of the great policy problems and declares that if there’s a localized liquidity problem anywhere in the world, it’s probably in China.

The final questions concerned the US-China dispute and technological leadership. Mr. Hall claimed that the trade frictions between them can prove beneficial to Canada and Mexico in the sense that we can act as substitutes in the market arena. He pointed out that we should not be opportunistic in a world where policy can change the next day, instead we should be aiming at a long term strategy that focuses in growing and developing sectors. Mr. Correa considered that it is important that knowledge be nurtured so we can have more educated labor for the future. The relative price of labor compared to capital has changed and now labor is the most expensive resource.

Finally, Mr. Hall said that Mexico has the ability to compete with China because of its growing workforce. He also said that a key strength Mexico has is its policy framework, which can be found among the top of the world. Both Mr. Hall and Mr. Correa agreed that there are opportunities for Canada and Mexico to enter into the global marketplace and compete with China and strengthen their mutual relationship.

Author: Verónica Aldana